Value II: The Moving Target

Anthony and I were talking about the last blog post – how to determine which of two similarly priced homes has more value – when he asked me a very good question: why were semis more expensive than bungalows back in 1993? For those of you who don’t know Anthony, he’s Anthony Malecki, one of the sales representatives at Advocate Realty. He doesn’t have as much grey hair as me and wasn’t a Realtor back in 1993 which is why he asked the question, but he has enough experience to know what he’s doing and I know that because his clients keep telling me how much they love him. But back to value.

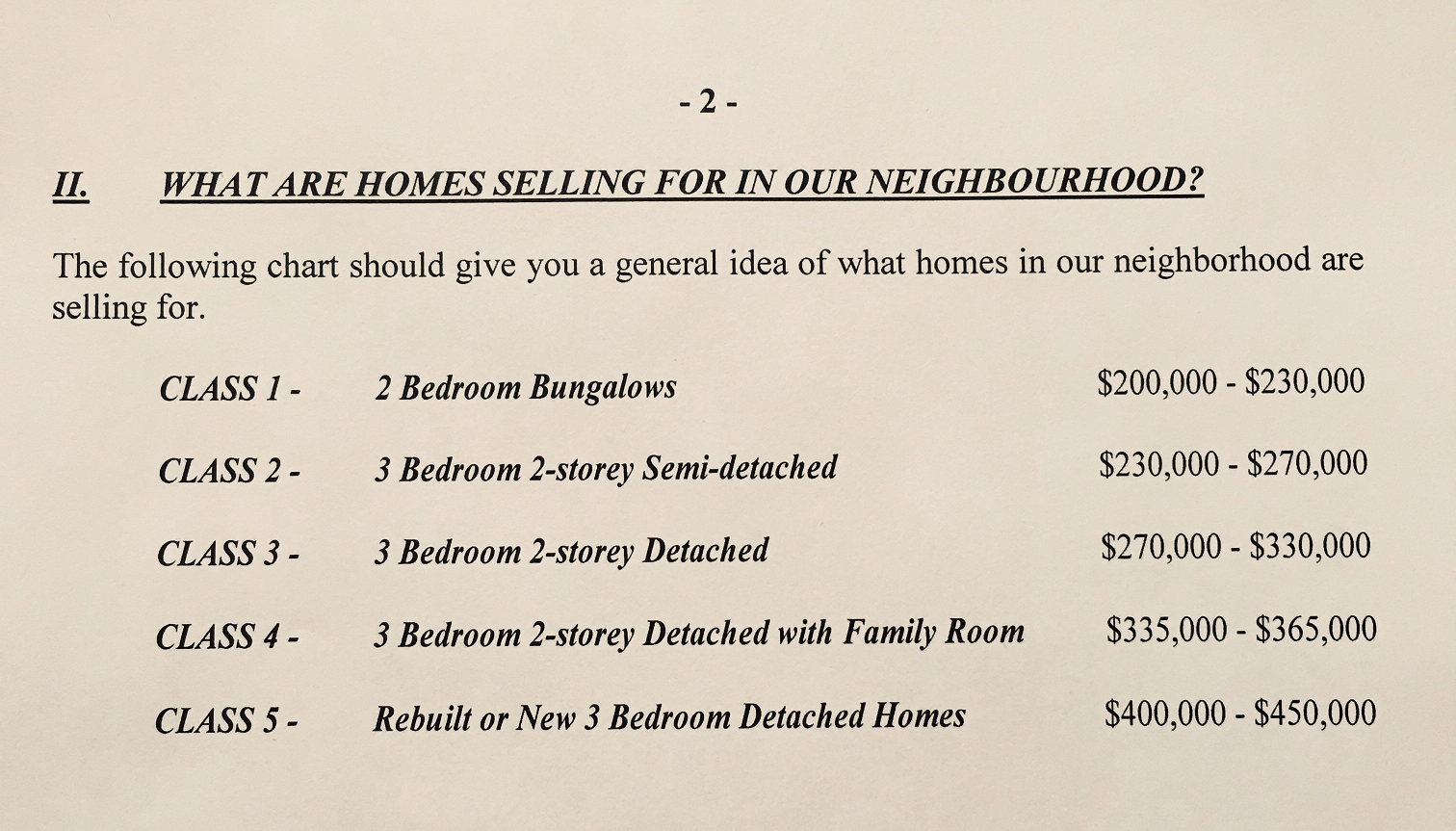

Let’s start by looking at the chart from the July 1993 issue of The Meltzer Real Estate Review below. Notice the lowly bungalow. It was the least expensive type of home at Yonge & Lawrence back in 1993. Less expensive than semis, as Anthony pointed out. But that’s no longer the case. Bungalows are now more expensive than semis.

How did that happen? Shouldn’t relative values be constant? Could silver be more expensive than gold next week?

You’ve heard me talk about the importance of location in real estate (perhaps you’re thinking “ad nauseum”). Well, there’s no arguing with the importance of location, which remains constant, but there are other determinants of value in residential value. Three of these are personal taste, supply and demand. It’s these other factors that cause relative values to shift because personal tastes change as do supply and demand.

They can cause relative values to shift quite a bit, in fact. Here are three examples of how they’ve affected the relative values of different types of properties at Yonge and Lawrence over the past twenty-five years.

Bungalows v. Semis

As Anthony pointed out, bungalows used to be less expensive than semis. The average bungalow cost approximately $215,000 in 1993 and the average semi cost $250,000. Today you’d have to pay about $1.6m for a bungalow and only $1.3m for semi. Why? Because back in 1993 there was hardly any new construction taking place in the neighbourhood. There were few builders bidding on properties. Bungalows had only 2 bedrooms, all on one level, and semis had 3 bedrooms on two levels. Buyers who were looking for a place to live preferred the extra bedroom and the two storey layout of semis so there was more demand for semis, thus supporting a higher price.

The market has changed tremendously over the past twenty-five years. As the demand for custom homes steadily increased, builders started buying bungalows to replace them with new custom homes. That trend continued and it’s now gotten to the point where there are almost no bungalows remaining in the neighbourhood. It’s highly impractical, if not impossible, to tear down a single semi to build a new home so the demand for semis has not increased as much. As a result, the price of a bungalow is now higher than the price of a semi and their relative values have shifted.

Unrenovated 2 Storey Detached Homes v. Renovated 2 Storey Detached Homes

The story doesn’t stop with Bungalows v. Semis. That’s where it begins.

Unrenovated 2-storey detached homes were selling for $270,000 in 1993 while renovated homes of that style were selling for $330,000. Bungalows were selling for $215,000 at that time. As builders bought more and more bungalows in the following years, the price of a bungalow increased and ultimately bungalows and unrenovated 2-storey detached homes started selling for almost the same price. When the supply of bungalows started to dwindle, some smart builders started buying unrenovated 2-storey detached homes to tear down and replace with custom homes. Why not? The price was almost the same as a bungalow, both types of home are on the similar sized lots and all builders care about is land value.

With builders buying more and more unrenovated 2-storey detached homes, the price of that type of home also increased and pretty soon they started selling for almost the same price as renovated homes.

Today, there’s hardly any difference in price between an unrenovated home and a renovated home so almost every detached home in the neighbourhood is a potential building lot (except for gorgeous, extensive renovations that were recently completed or homes with additions that can still sell for a bit of a premium). The relative values of detached homes has shifted, both as between bungalows and detached homes and as between renovated and unrenovated homes.

One Semi v. Two Semis

Is that the end of the story? Nope. We can’t overlook what’s been happening with semis.

As the preference and demand amongst buyers for new custom homes increased, so too did the demand for building lots by builders. I’m sure many builders thought to themselves “What a shame there are so many semis in this neighbourhood that can’t be used as building lots.” Until one day someone got the idea to buy two attached semis, tear them both down and build two new homes, assuming the lot sizes were large enough. Wow! A whole new supply of building lots!

The effect of the builders’ demand on the value of semis is nothing short of staggering. A semi on a decent sized lot might sell to a buyer who wants to live in it for $1.3m. But if the owner of that semi sells at the same time as the owner of the attached semi, they may each sell for $1.6m to a builder. That’s close to a 25% premium for selling at the same time as your neighbour. How’s that for a massive change in relative values?

Real estate has proven itself to be a good long term investment, but as we’ve seen today it can be difficult to estimate the long term values of different types of real estate because it’s like hitting a moving target. And we’ve only been looking at one small neighbourhood! The same thing happens all over the world. Some neighbourhoods go up while others go down and some housing styles appreciate or depreciate more than others. One thing will always hold true: the three most important things in real estate are “location, location, location” (sorry, couldn’t miss an opportunity to repeat that). That’s why you should focus on location if you invest in real estate for the long term. The other factors change and can be very difficult, if not impossible, to predict.

As always, I’d be happy to talk to you about your options if you’re thinking of buying or selling in the near future. Also, if you know anyone who is interested in learning how the market works and would like to receive the kind of help that involves honest answers, straightforward advice, no pressure and being treated like family, please let me know the best way for me to connect with them because I’d like to offer them this kind of help. And as always, don’t be shy if you have any questions or comments about this post! Thanks for reading.