2018 Real Estate Market Forecast

Is it too early to predict what I think might happen in the residential real estate market in central Toronto in 2018? I don’t think so. Because I already spend so much time mulling over what’s going on in the market, I don’t need to wait until January. And I figure I may as well share my prediction with you now in case it contains some information that’ll help you plan in advance for your 2018 move. If something happens between now and January 1 that changes my prediction, I’ll be sure to let you know.

Here’s a behind the scenes look at what goes on when I make a prediction:

Figuring Out What’s Going On In The Market

It would be really easy for me to throw a number at someone when they ask me what their home is worth or how much they should pay for a home. But I can’t do that. I sweat the details. It’s my blessing and my curse. I have to research and analyze the numbers so I can give them the best answer possible. I know no other way.

That’s why I’m always thinking about the real estate market. If I want to keep being the best I can be it’s something I need to do. I need to know what’s happened historically, what’s happened recently, what’s happening now and what’s likely to happen in the future, both short and long term. Here’s why:

Let’s say you’ve decided to list your three bedroom semi on Woburn this week. I need to know the recent sale prices of the last few semis that sold in the neighbourhood so we can set the right list price (and we already know how important THAT is!) because buyers will look at those sale prices to determine how much your home is worth. And if you’re buying, I need to know these same sale prices so I can advise you on how much you should pay. I also need to know what’s going on right NOW to determine if anything has happened that would change how the market perceives these recent sale prices. Knowing what’s happened recently and what’s happening now is crucial when it comes to advising clients about what’s most likely to happen in the short term.

But what about “ancient” market history? Why’s that important? Well, history tends to repeat itself. Having been in real estate for over 25 years, I’ve seen a lot of different markets and recognize certain patterns. This gives me a feel for what might happen in the long term. When clients ask me whether to buy or sell now or in a few months or a year, I need to be able to advise them if I think prices are likely to go up or down, if homes will be selling quickly or slowly and if there will be many or few homes on the market. “Ancient” history, together with recent history and what’s going on in the market right now all help me answer their questions about what may happen in the market in the long term.

I usually don’t pour over statistics when I think about the market because I know numbers can say different things to different people and because they don’t tell nearly the whole story when it comes to residential real estate. This market involves emotions. It’s not strictly a numbers game. There are times when buyers and sellers do things that make no financial sense at all, yet they still do them and they still affect the numbers. The longer I’m in this business, the more my predictions depend on my gut feel and understanding of what people might do in certain situations and how they’ll react to a specific property. It has more to do with human nature than it does with science.

So if you see me on the street or at a party and I pause when you ask me “How’s the market?” or “How much is my house worth?”, you’ll understand that I’m not pausing because I don’t know the answer or don’t want to answer you. I’m pausing because the wheels are in motion trying to come up with the best answer possible.

Now, on to my forecast for 2018.

2018 Real Estate Market Prediction

This market is certainly different than what we experienced early in the year, but there’s nothing new and mysterious about it:

Some homes are selling within a week with multiple offers for very high prices, most homes are selling for reasonably high prices in reasonable periods of time (2-8 weeks) and some homes are taking longer to sell (more than two months) and are selling for what seem like low prices.

Now, here’s the thing – this is the way the market’s been for the past twenty (20) years here in central Toronto. The key factors have remained the same, but their relative values keep changing. What do I mean? To make things simple, these are the four questions to ask if you’re trying to understand the market:

1. What percentage of homes are receiving multiple offers?

2. How much above list prices are buyers paying?

3. What do buyers expect to pay and sellers expect to receive if there aren’t multiple offers?

4. How long is it taking for homes to sell if they don’t receive multiple offers?

For example, when the market was very hot, like it was in early 2017, a large percentage of homes sold with multiple offers, buyers were paying 15-30% above list price, buyers and sellers still expected homes to sell for above list price if there weren’t multiple offers, and homes were selling in a week or two even if they didn’t receive multiple offers. Today, I’d say a small percentage of homes are receiving multiple offers, buyers are paying 5-10% above list price if there are multiple offers, buyers and sellers expect a home to sell for 2-10% less than list price if there aren’t multiple offers and homes are selling in 2-8 weeks if they don’t receive multiple offers.

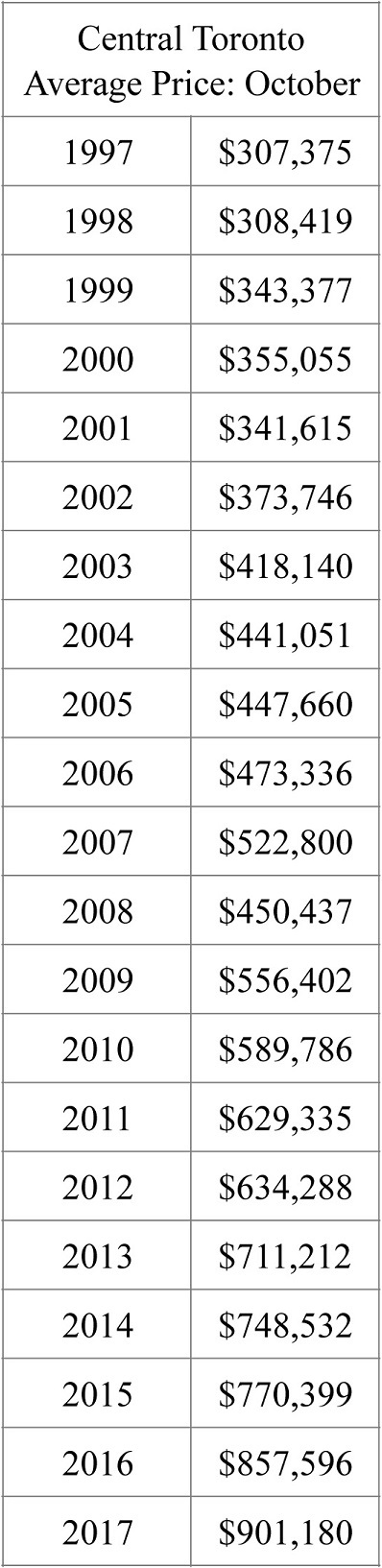

Not only has the market been this way for the past twenty years, if you look at the chart you’ll see that prices have climbed pretty steadily, too. The average price for a home in central Toronto for the month of October has increased year over year in eighteen of those years. So even though prices may seem low now and the market may seem slow relative to earlier this year, historically the market is still very strong and it’s still a sellers’ market, as it has been for most of the past twenty years.

That’s what you’ll see when you take an overview of the market and look at “ancient” history. But if you start to focus on micro events, such as tighter mortgage rules, you lose sight of the big picture and of what’s most likely to happen. But isn’t this normal human behavior? We tend to look at what’s right in front of us and react to it instead of taking a step back and taking a deep breath before analyzing the situation calmly and rationally. I admit to being guilty of this, too. It reminds me of exam time during my university days. You could feel the tension in the air. I always preferred not to study where other people were studying and tried to show up for my exams as late as possible (without missing them) so I wouldn’t get caught up in the stressful atmosphere. It’s the same thing with the real estate market. Instead of worrying “How’s this going to affect the market?”, it’s important to take a step back, take a deep breath and then look at the big picture.

Let’s take a look at the chart again. Prices have increased year over year for eighteen of the past twenty years. I could give you plenty of examples of events which should or could have derailed the real estate market – the dot.com bubble bursting, uncertainty due to wars in Afghanistan and Iraq, Canada’s natural resources sector taking a huge hit – but I’m going to use one example to show you how strong the market is: 9/11. Our world changed on 9/11. Of that there’s no dispute. And yet the average price in October 2001, just one month after 9/11, was only 3.8% lower than the average price in October 2000. If 9/11 couldn’t derail the market, not much can.

Based on this, I’m expecting 2018 to be a good year for the real estate market in central Toronto. It won’t be crazy like it was in early 2017, but it’ll be a strong market like it is now (see above) with short supply, strong demand and increasing prices. There’s still way more demand than supply and this is being continually bolstered by the large number of people immigrating to Toronto every year. I can’t say if prices in Lawrence Park will go up by as much as prices in Davisville Village because every niche market is different or if condo prices will increase more than the prices of homes (although I do think condo prices will increase more because there’s more demand at the lower price levels). And I can’t say by how much prices will increase in each niche, but I do think that, on the whole, prices will increase.

Does this make sense to you? It makes sense to me, but I have to admit I’m not always right. I expected prices and sales to rebound more quickly after they started slowing in April/May 2017 and they didn’t do that. Predicting what’s likely to happen over the next few months is difficult because it involves assessing how quickly people will react to certain facts and people don’t always act rationally. I expect the market to start strongly in 2018 and I expect 2018 to be a good year overall, but please take my prediction for what it is – one person’s opinion of what’s likely to happen in the real estate market in central Toronto in 2018. And if you’d like to know my opinions about the best times of year to sell or buy, check out Should We List in January, February, March or Later? and 2 Good Times to Buy (1 is Now!).

If you know anyone who is interested in learning how the market works and would like to receive the kind of help that involves honest answers, straightforward advice, no pressure and being treated like family, please let me know the best way for me to connect with them because I’d like to offer them this kind of help. And as always, don’t be shy if you have any questions or comments about this post! Thanks for reading.